Investment Approach

We bring together insights-driven perspectives, a rigorous investment and risk-mitigation process and investor-operator capabilities to execute on all aspects of an investment’s lifecycle and drive better outcomes.

Our experienced teams—whose interests are aligned with both investors and occupiers—employ a consistent and rigorous insights-based investment and risk-mitigation process. We aim to align investor goals with occupier needs and believe that helping our investors understand the changing needs of end users will create superior long-term performance.

Finora Global Capital Limited Investment Management believes that performance begins with preparation. We are primarily a bottom-up, fundamental research-based investment firm. We rely on our in-house, proprietary research efforts coupled with nimble trading to build relative value-driven portfolios that aim to provide attractive risk-reward characteristics. We take a team approach to managing our clients’ portfolios, with ideas generated by portfolio managers, research analysts and traders alike. we believe there is no substitute for experience, and our experience has been tested through various market environments.

At Finora Investment Management , we believe that sustainability is important- as such, we are aware that we can have a positive impact on our people, communities and clients by focusing on sustainability matters. We are also the institutional asset manager which has a history of More than a few years helping people around the world protect their finances and build for the future.We also engage actively with company leadership. Our investment analysts frequently interact and engage in discussions with a firm’s senior management throughout the initial due diligence process and as part of the portfolio monitoring process. We maintain an ongoing dialogue with company management to target improvements across a number of sustainability metrics.

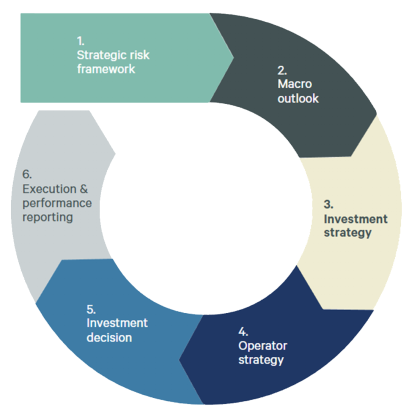

learn more about our investment strategy:

- Strategic risk framework

Design a unique risk-return objective for each investment program, including overall targets, investment limitations, geographic/sector distribution and risk tolerance

- Macro outlook

Review our market projections regularly, adjust to reflect shifting economic factors and ensure our investment programs are best aligned with the current cycle

- Investment strategy

Evaluate existing holdings for asset retention, potential acquisitions and near-future dispositions based upon market intelligence

- Operator strategy

Approve acquisitions, dispositions and financing to assure alignment with the program’s strategic framework; identify potential risks and growth opportunities through a multi-stage due diligence process

- Investment decision

Utilize our operator division’s expertise and our connections with operating partners with the goal of optimizing each asset’s lease-up, cash flow and value enhancement

- Execution & performance reporting

Monitor and report portfolio risk metrics and performance attribution quarterly